Mutual funds are considered a favorable option if you have a long-term investment goal. Unlike real estate, mutual funds will help you reduce your risks over time. Equity mutual funds are taxed on gains over million dollars. If you are an investor with a tight budget, investing in real estate isn’t a bad idea.

Pros And Cons Of Mutual Funds Vs Real Estate

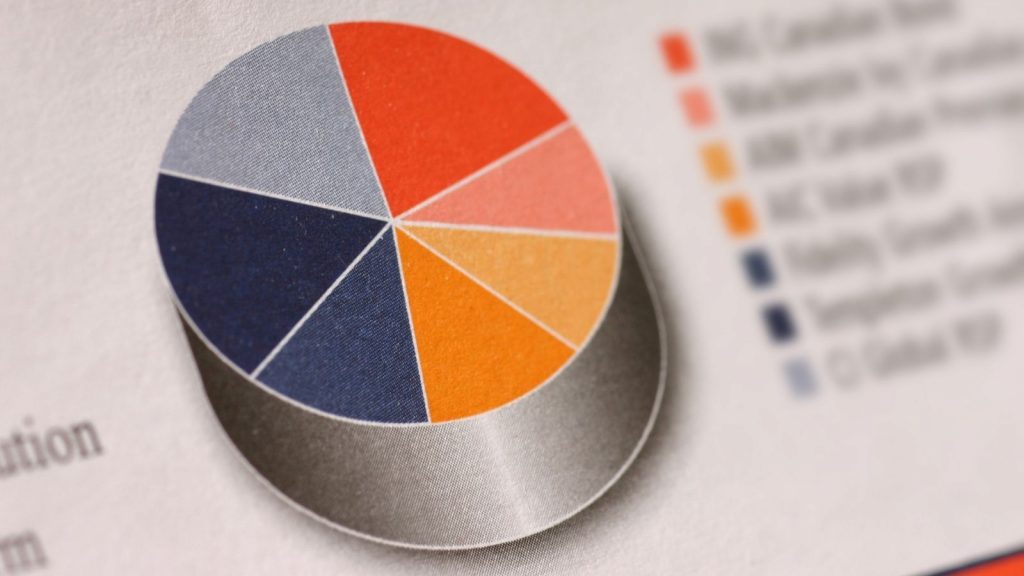

Diversifying your portfolio can be achieved through investing in real estate. Many real estate mutual funds invest in commercial properties, including REITs. This fund can be tax-favored and have lower management fees than real estate direct investments.

However, critics of real estate mutual funds claim that they cannot compare to investing directly in real estate. In short, real estate mutual funds have their advantages and disadvantages.

In addition to diversification, mutual funds allow investors to own shares in multiple businesses. Investing in a real estate mutual fund allows you to acquire multiple properties quickly. You can invest in either a government bond or a particular kind of stock.

Mutual funds are less risky than real estate due to their investment in relatively stable assets. Furthermore, it’s easier to sell mutual funds compared to other investments.

Long Term Mutual Funds

Whether mutual funds are better for long-term investing is up to you. Real estate is often risky and requires a high level of trust and discipline to avoid losing money.

Using mutual funds reduces these risks and is a better option for long-term investors. Therefore, it’s best to invest in both types of investments.

Down Side Of Mutual Funds

While real estate is a better choice for long-term investors, it’s essential to consider the risk involved. Although mutual funds may be less risky, the former option has greater potential for financial loss.

In addition, real estate is more stable than mutual funds, which makes it an excellent investment for beginners. Investing in mutual funds means you cannot exercise authority over the assets.

Real estate investment is a more accessible and innovative option for investors with down payments, while mutual funds have lower risks. But if you don’t have money to invest, real estate is the better option.

But real estate is not tax-exempt, so you’ll have to pay capital gains tax. Moreover, you’ll get to deduct more expenses. In mutual funds, you’ll have fewer options for the property, which is why they are more expensive.

Real estate is more volatile than mutual funds, but it’s a better option for investors who want to invest for the long term. For example, real estate investors can deduct more expenses and avoid capital gains tax.

Furthermore, taxes apply to real estate. But some mutual funds are tax-exempt. These types of investments are still worth considering, but they have drawbacks.

Real estate is a better option than mutual funds in a long-term investment. Although the risk is lower, a significant return requires a substantial cash investment. Both are unsuitable for individuals seeking short-term investment opportunities.

Having a portfolio that includes both types of investments is far more advantageous. It is best to start investing in a reputable fund that offers high-quality performance.

The biggest drawback of mutual funds.

The most significant disadvantage of mutual funds is their high-risk factor. A mutual fund’s return depends on the country’s economy in which it’s located.

Presently, world economy is facing a downturn, the property will likely lose its value, making it less risky than a real estate investment. Despite the risks of the real estate market, it is still an excellent option for long-term investors.